Overview

Chennai FTZ

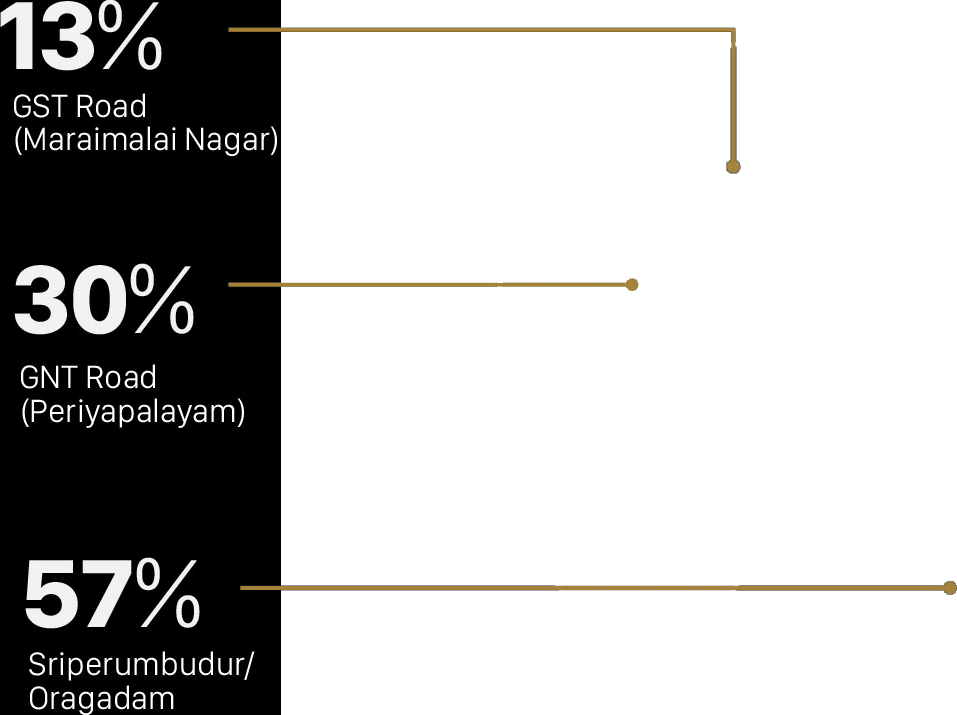

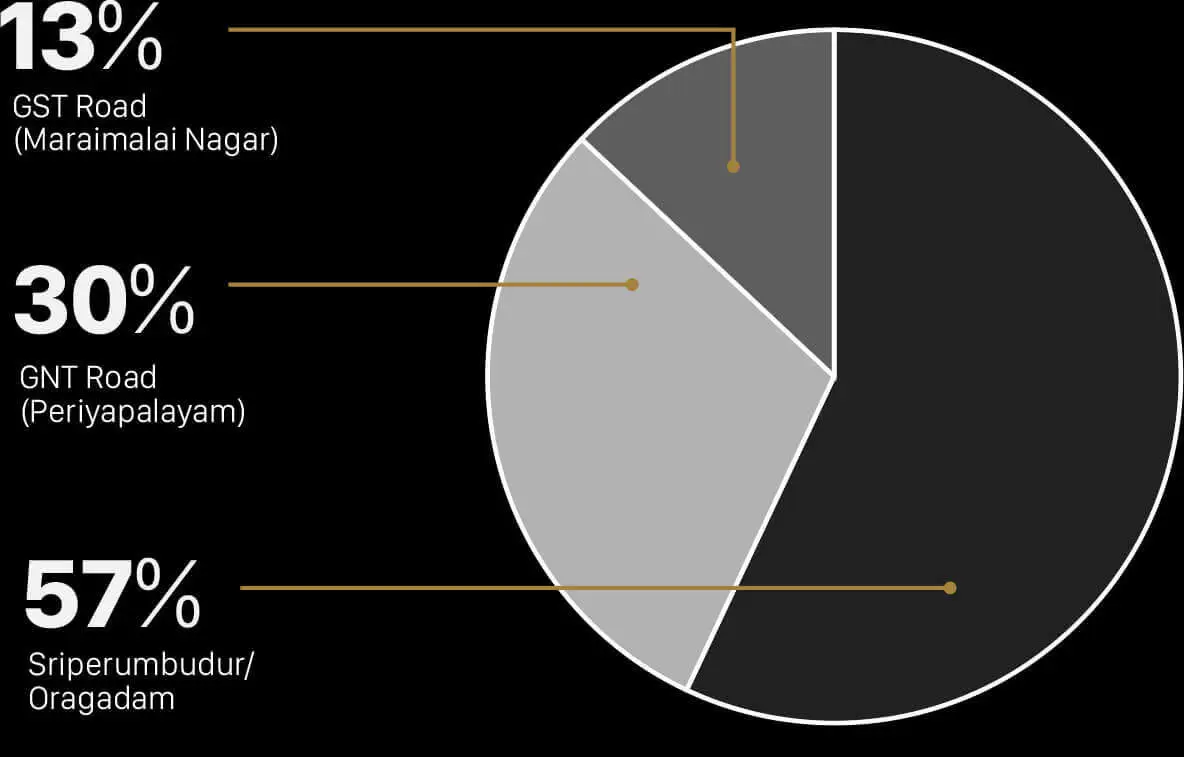

Leading Multi-Sector SEZ spread across 245 acres, located in Mannur, Sriperumbudur in proximity to Chennai-Bangalore Industrial Corridor (NH-48). The park offers seamless connectivity to Ennore Port, Chennai Port, Katuppali Port, Marai Malai Nagar and Mahindra World City (Chennai).

| Government of India - Ministry of Commerce |

Export Excellence Award

The award is a recognition of our commitment in providing world class services – infrastructure, management, and facilities.

Features

Multi-Sector SEZ with Tax Exemptions

Industrial Park

(245 Acres)

Located on the Chennai Bangalore Industrial Corridor

Institutional Ownership

Plug ‘N’ Play Infrastructure

LEED Platinum Certified

Leasable Area Ranging: 13,000 sq. ft. - 0.42 million sq. ft.

24x7 Customs Clearance, Open Storage and Container Yard

Long Term Lease 15-30 Years (Built-to-Suit A vailable)

26 Meter Wide Arterial Road

Rainwater Harvesting and Natural Reservoirs

24x7 CCTV Monitoring

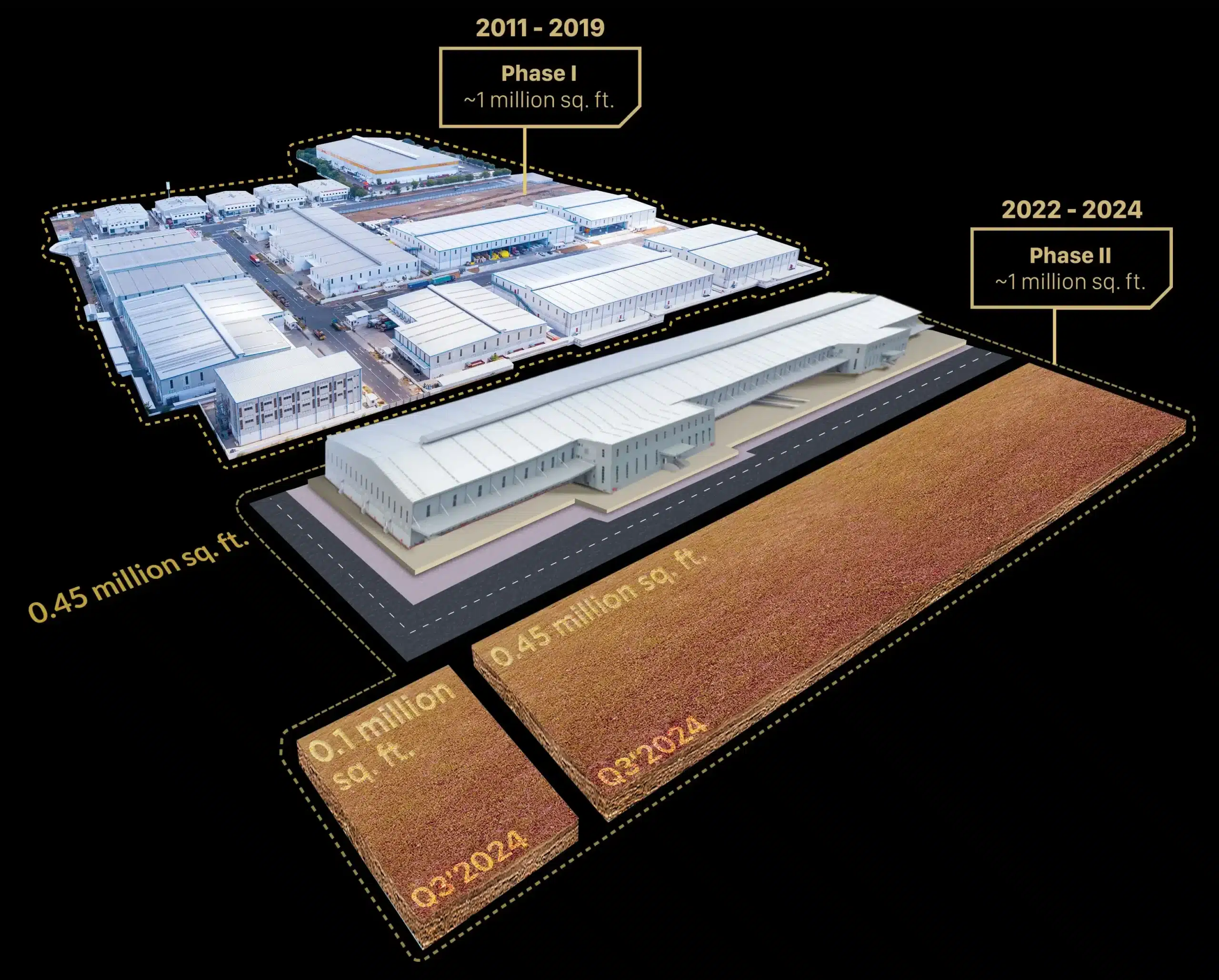

Layout

Specifications

Roof

Standing Seam Roof; Leak Proof Warranty

Height

13 Meters Clear Height at Eaves

Office

Independent G+2 Block

Ventilation

Roof Monitor and Louvers; 6 Air Changes/Hour

Lighting

Natural and LED Lighting

Shutters

1 Motorised Rolling Shutter/98,500 sq.ft.

Docking

1 Dock Leveler/8,950 sq.ft.; 10 Tonnes Capacity

Lift

1 Passenger Lift/98,500 sq.ft. to Office Block

Flooring

FM2 Flooring; 7 Tonnes/sq. mtr. Loading Capacity

Ramp

1 RCC Ramp/98,500 sq.ft.; 3.3 Meter Wide

Fire Compliant

ESFR Fire Sprinkler System (K-200)

Amenities

Washroom, Security Room and Pantry

Key Highlights

2nd

Highest Container Traffic in India

3

Industrial Growth Corridors

3

Modern Container

Ports

3rd

Largest Indian City Based on per-capita GDP (2015)

1

International

Airport

45%

India’s Automobile Exports

33%

India’s Auto Parts Production

16%

India’s Electronic Hardware Manufacturing

Total Completed Stock: 24 Million SQ. F T.

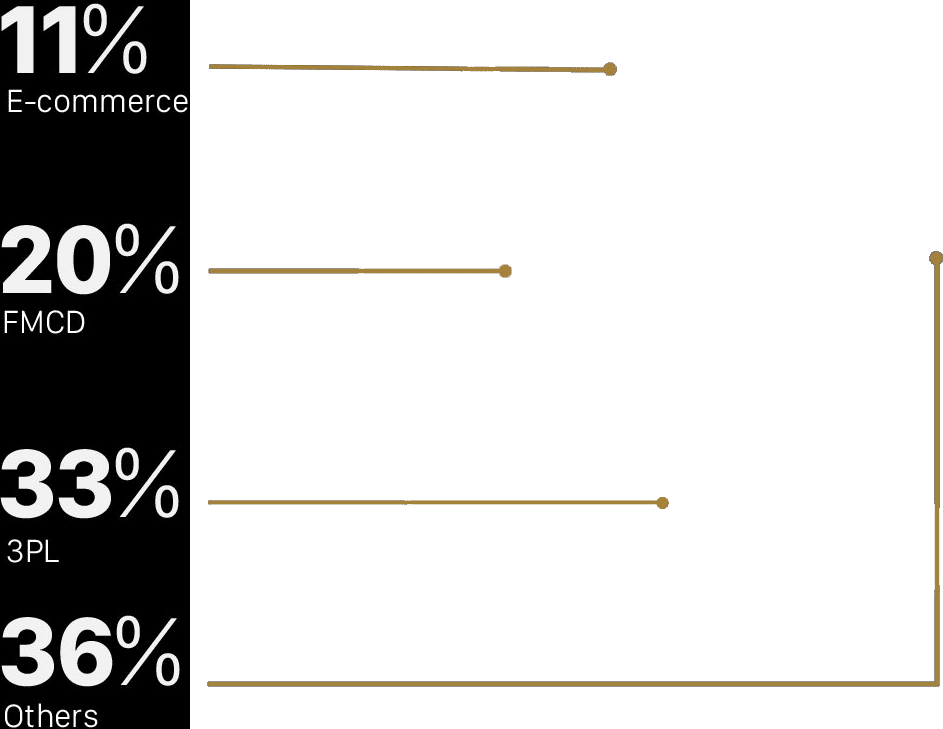

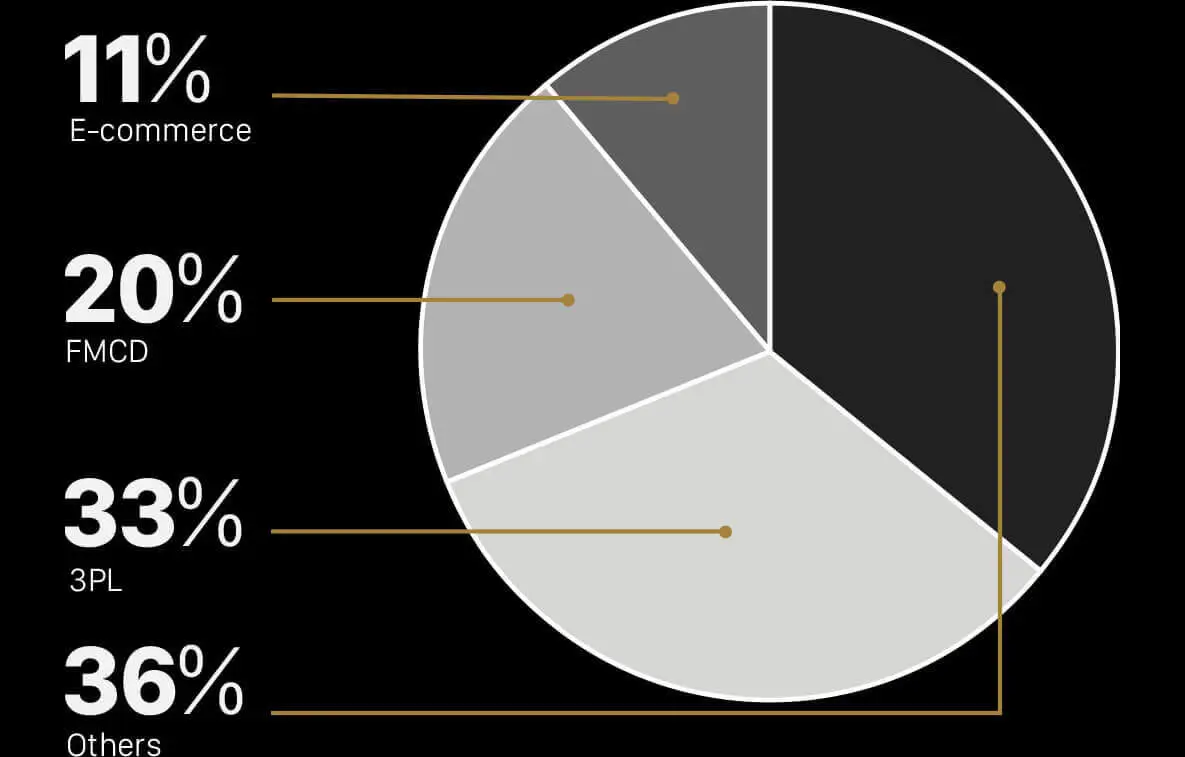

Key Industries

Automobile and Auto Ancillary

Electronics

Manufacturing

Benefits

Multi-Sector SEZ’s are deemed foreign territories, ports, warehouses for storage and other value-added activities.

Under the customs law, Unit holders are allowed to hold inventory on behalf of foreign suppliers/ domestic buyers.

- Exemption from stamp duty, tax on electricity and transfer of goods to another SEZ/ bonded WH etc.

- Opportunity for unit holders to undertake value added services

- Duty deferment benefits; reduced working capital and allowing custom clearance on JIT (“Just-in-Time”) basis

- Trading of goods (EXIM) is permitted

- Domestic procurements of goods and services are treated zero rated supplies

- Exemption from tax on exports of goods and services

- Exemption from multiple cesses for authorized operations

- Domestic suppliers can discharge export obligations on imports

- 100% FDI (automatic) in manufacturing sector

- No cap on foreign investments for small scale Industries

- Retain 100% foreign exchange receipts in foreign currency account

- Sub-contracting of manufacturing processes permitted

- Custom duty on capital goods payable on depreciated value

- License valid for 5 years